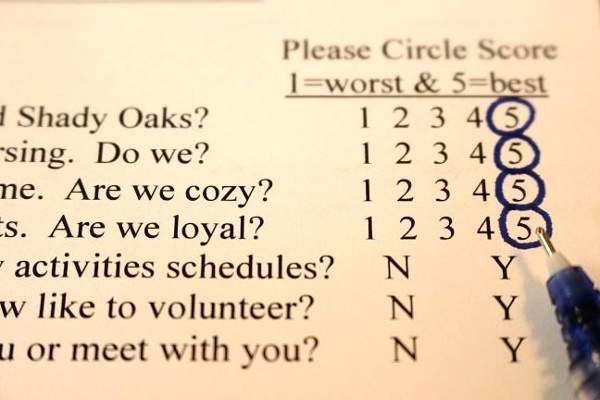

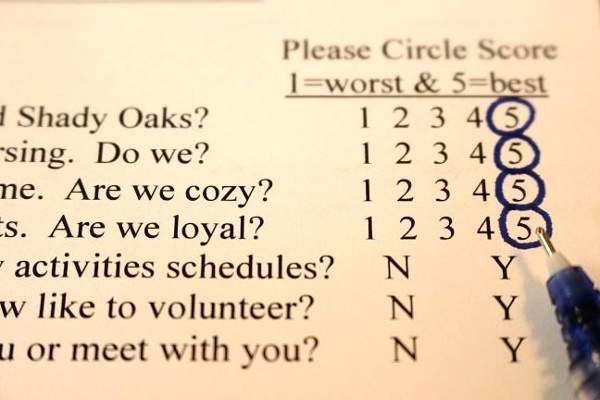

Customer Recommendations, Family Survey 2017

February 15, 2017

Intro to Home Care

August 15, 2017

Customer Recommendations, Family Survey 2017

February 15, 2017

Intro to Home Care

August 15, 2017

Connecticut Pays Your Nursing

I found a program that helps people in need to afford assisted living services. Its name is the Connecticut Private Pay Assisted Living Pilot Program. It covers up to $2,360 monthly for nursing care within assisted living communities. This blog shares what I know so far.

I. Background

The Private Pay Assisted Living Pilot Program is a remarkable budget innovation. When seniors enter nursing homes and depend on Long-Term Care Medicaid, this is expensive for Connecticut. To save money, the state wants to instead help people afford private pay care in assisted living homes. So, for assisted living residents with qualifying financial and medical needs, the state pays up to $2,360 of their monthly medical costs. This is powerful. If residents have sufficient social security, pension income, long term care insurance, Aid & Attendance VA pension assistance, or family support, this $2,360 can help them stay in assisted living homes and never need a nursing home or Long-Term Care Medicaid assistance. Meanwhile, the state saves money, because the Pilot Program costs the state less than Title 19 Medicaid at nursing homes.

II. Assistance

The Pilot Program only helps pay nursing expenses charged by the assisted living home. The state sends funds directly to the assisted living home. The home then charges less to the resident, so the resident saves money and avoids nursing home placement.

As a foundation, the program pays $4.41 daily for “core services, light housekeeping, meal preparation, and laundry.” Based on 31 days in a month, this equals $136.71 monthly.

Beyond this, the program covers each resident’s “Personal Service Package.” “Hours per week” of nursing care, determine each resident’s service package. These are the four packages:

#1. Occasional (1- 3.75 hours weekly) pays $24.02 daily or about $744.62 monthly.

#2. Limited (4 – 8.75 hours weekly) pays $39.56 daily or about $1,226.36 monthly.

#3. Moderate (9 – 14.75 hours weekly) pays $55.71 daily or about $1,727.01 monthly.

#4. Extensive (15 – 25 hours weekly) pays $71.73 daily or about $2,223.63 monthly.

*Note: I multiply daily amounts by 31 to estimate monthly totals.

So, the maximum monthly aid for core services plus personal service package equals:

#1. $136.71 + $744.62 = $881.33 monthly.

#2. $136.71 + $1,226.36 = $1,363.07 monthly.

#3. $136.71 + $744.62 = $1,863.72 monthly.

#4. $136.71 + $2,223.63 = $2,360.34 monthly.

Actual amounts can vary by income. For residents with incomes under $2,010 (not including VA Aid & Attendance and most types of long term care insurance), they get the maximums.

However, for residents with incomes over $2,010, they must complete an “applied income worksheet” and find their incomes after deductions. [Note: There are many acceptable deductions, including a standard $2,010 personal needs allowance deduction, an average monthly out-of-pocket medical expenses, unpaid medical bills, income diverted to pooled trusts (only for residents applying for T19), and Medicare Part B or other medical insurance payments.] After deductions, the remaining income is “applied” to care. Residents receive the maximum minus this applied income. Most residents with high incomes still receive partial program assistance. However, for residents with very high income and/or low care packages, this calculation may result in a benefit amount at or below zero. If so, the program will not help their costs.

There is another important rule. All assistance is either state-funded or Medicaid-funded. State-funded residents generally have higher assets (see below), and they must pay 9% of their benefits back into the program. So, for example, a state-funded resident with income $2,010 or below and package #4 would still receive $2,360.34 monthly in aid but would also pay $212.43 ($2,360.34*9%) towards the cost of their care. In effect, their aid is $2,147.91. Medicaid-funded residents generally have lower assets (again, see below). They do not contribute this 9%. Connecticut created this 9% rule to help fund the Pilot Program and help it survive.

III. Eligibility

The following criteria determine eligibility for the Pilot Program:

- Residency: The person must be a resident at a participating assisted living home in Connecticut. Shady Oaks participates in the program, and its residents meet this requirement.

- Age: The person must be 65 years of age or older.

- Medical (Functional) Need: Residents must need “help” with three or more activities of daily living (ADLs): bathing, dressing, toileting, transferring, eating, or medication management. “Help” is assistance that is necessary for protecting the resident from harm.

- Financial Need by Income & Asset Limits:

- State-Funded: Most participants use the state-funded program. To be eligible for this state-funded Private Assistance Living Pilot Program, an unmarried resident must have less than $36,270 in assets. Married residents must have less than $48,380. If they have more than this, and if they receive a spousal assessment protection exemption, they might still qualify.

- Medicaid Funded: To be eligible for the Medicaid-funded Pilot Program, individual residents must have under $1,600 in assets, and married couples must have under $3,200. This limit can be higher, if couples receive a spousal assessment protection exemption.

- Transitions & Special Cases: Most participants begin with the state-funded program. If their income is below $2,205 and their assets fall below $1,600, they must then apply for the Medicaid-funded program. If residents have below $1,600 in assets but have income above accepted limits, they may establish a Pooled Trust to qualify for the Medicaid Funded program, while they can still apply trust income to pay for their room and board.

- Real Estate: The Pilot Program does not support residents who still own property. To qualify for the program, residents must post properties for sale and provide a listing contract to the state. If the sale then pushes residents over their asset limit, the state suspends their program participation until they spend back down to their qualifying asset limit. If residents sell property and retain “Life Use”, the value of “Life Use” (determined by the state) must go to the resident. If it does not, the state counts this a transfer of assets and imposes a penalty period.

- Asset Look Back: Asset eligibility includes a “look back.” The state must review the resident’s five previous years of financial activities. This includes all accounts owned and co-owned by residents, including those of their spouses, during that time. For the two most recent full years from the date of application, the state examines all monthly statements. For the three other full years, the state just needs federal tax returns or December statements with year-to-date interest. Residents must explain any deposits or withdrawals of $5,000 or more. In general, this look back follows the same standards as the look back when applying for Medicaid.

IV. Applications

- It is important to apply as soon as possible, even if you are over asset at the time, so benefits can begin in time to be helpful. It is wise to get started if eligibility becomes foreseeable. Speak with your assisted living home to discuss eligibility. At Shady Oaks, our families should call Tyson, the Owner and Executive Director. His office number is 860-583-1526. His mobile phone number is 960-960-7321.

- Tyson will notify the Department of Social Services about the resident’s upcoming eligibility. There is a strict statewide program cap of 125 participating residents. So, as of March 2017, there is a wait list, and this takes about 2-3 months. To join this wait list, Tyson needs only to send in the resident’s date of birth, social security number, monthly income, total assets, name of contact person, and contact person’s phone number.

- While residents await the program, they may be eligible for the Department of Social Services CT Home Care Program Fee For Service (FFS) Program. FFS provides health care services at agreed upon time(s), which can help lessen assisted living costs.

- When the resident’s name tops the wait list, a nurse will call to speak with the resident and/or the resident’s power-of-attorney to collect preliminary health care and asset information. The nurse then sends a report to the “Access Agency.” For Shady Oaks, the Access Agency is Connecticut Community Care Incorporated (CCCI) in Wethersfield.

- The Access Agency (CCCI) then sends a care manager to evaluate the resident and determine their health care needs. The care manager will also help the family through the application paperwork. The resident/POA must provide bank statements and itemized VA benefits if they receive an Aid and Attendance pension. With helpful guidance from care managers, families do not typically need to hire any extra private or legal assistance.

- The state processes the application. This takes about 6-8 weeks or a little longer if additional documents need to be gathered.

- When approved, the Department of Social Services Community Options Unit will notify Shady Oaks and begin electronic payments to its account. Shady Oaks will then deduct the amount of the payment from the resident’s monthly rate, so the resident keeps this money.

- Residents and their power-of-attorney should keep copies of all documents for their records. Packages are updated as care needs change or during annual re-assessments. During the annual re-assessment an updated W1-LTC (application) must be provided (no previously submitted documents are needed.)

V. Additional Resources:

- CT Department of Social Services: http://www.ct.gov/dss/cwp/view.asp?a=2353&q=391114

- A useful 2015 blog post from a law firm: