Update on Renovations & Wellness at Shady Oaks Assisted Living in CT

December 15, 2016

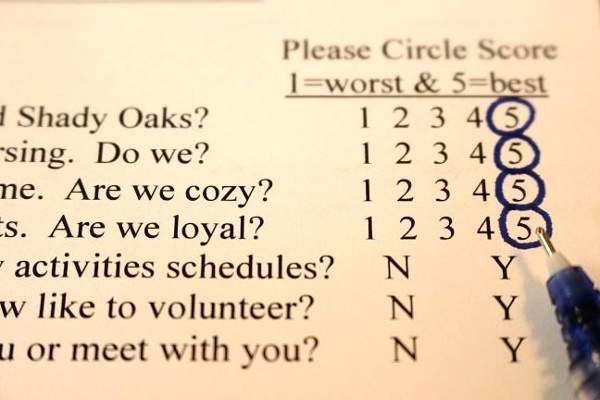

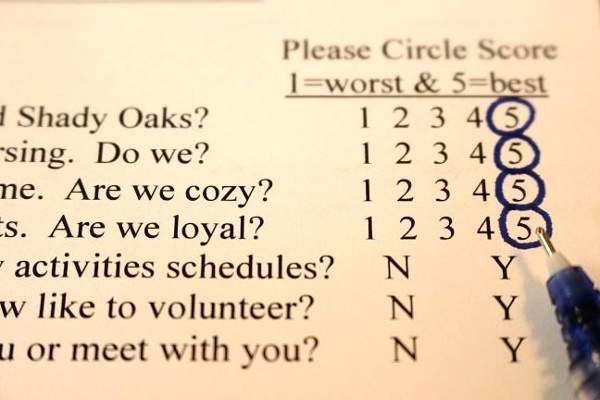

Customer Recommendations, Family Survey 2017

February 15, 2017

Update on Renovations & Wellness at Shady Oaks Assisted Living in CT

December 15, 2016

Customer Recommendations, Family Survey 2017

February 15, 2017

How To Apply for VA Pensions

Over 70% of men over age 80 are veterans. Many women seniors are veterans, veteran spouses, or widows. This blog describes how to apply for VA “Aid and Attendance Pension” and the “Survivor’s Pension.” These pensions help make assisted living care and home care affordable. Unfortunately, they are complicated. This blog shares my best general understanding of them. Please note the VA added rules for “Net Worth” and a “3-Year Look Back” on 18 October 2018.

How much do these pensions pay? Benefits equal the difference between your “countable income” and “annual pension limit.” You can estimate your VA pension amount with three steps.

- Begin by estimating your “countable income.” The VA defines this as “income from most sources as well as from any eligible dependents. It generally includes earnings, disability and retirement payments, interest and dividend payments from annuities, and net income from farming or a business. Some expenses, such as unreimbursed medical expenses, may reduce your countable income.” Married couples have incomes counted together.At Shady Oaks and other care homes, rent is deductible, so countable income for our residents is usually zero.

- Next, find your pension limit. As of 2018, the annual pension limit for a single veteran is $21,962 and for a survivor is $14,133. The pension limit for a married veteran is $26,036.

- Finally, if your countable income is less than your limit, the VA pays the difference in 12 equal monthly payments. Veterans receive up to $1,830 monthly. Surviving spouses get up to $1,176. Married veterans get up to $2,169. All of our participating residents have full pensions.

To be eligible for the “Aid and Attendance” Pension, veterans must meet these standards:

- Age: The veteran must be 65 or older.

- Discharge: The veteran’s discharge had a characterization better than “Dishonorable.”

- Active Duty: The veteran must have served for 90 consecutive active duty days.

- Wartime: The veteran served one day anywhere in the world during one of these times:

World War II — 7 December 1941 to 31 December 1946

Korea — 27 June 1950 to 31 January 1955

Vietnam — 5 August 1964* to 7 May 1975

*Service in Vietnam from 28 February 1961 to 5 August 1964 also qualifies.

Gulf War — 2 August 1990 to TBD*

*Gulf War veterans must have served on active duty for over 2 years.

- Documentation: The veteran needs his or her discharge paperwork.

- Health Need: The veteran needs help with two or more activities of daily living, including:

Bathing, Dressing, Eating, Toileting, Transferring, and Ambulating Within Home

Or, the veteran has a diagnosis of dementia or Alzheimer’s;

Or, the veteran has extreme blindness.

- Financial Need: The vet has under $123,600 in “Net Worth.” Net worth equals countable income, plus saleable assets, plus any below market value transfers from after 17 October 2018.*

- Countable income is annual income deducted by projected medical expenses. It is zero or higher. At Shady Oaks, after deducting rent, most residents have zero countable income.

- Saleable assets are savings, property, and real estate, excluding one home and family vehicle, minus mortgages or encumbrances on asset-counted savings, property, and real estate. The VA permits care home residents to rent their former homes for extra income. The VA counts saleable assets as evenly divided among up to four non-spousal signatories on accounts. For example, a $160,000 account held by a veteran and his POA son, equals $80,000 for the vet.

- Below market transfers are where vets gave assets without fair compensation or put money into non-saleable financial instruments (like irrevocable trusts) after 17 October 2018. The VA now has a “3-Year Look Back” policy, but it does not count transfers before this date.

- For net worth under $123,600, the veteran is eligible. If below market transfers cause net worth to exceed $123,600, the VA will delay benefits. The “penalty” months of delay equal the excess divided by the maximum pension amount. The maximum penalty lasts for 5 years.

*The VA no longer considers life expectancy or asset depletion as factors for net worth.

To be eligible for the “Survivor’s Pension”, widowed spouses must meet these standards:

- Age: The surviving spouse must be 65 or older.

- Marriage: The deceased spouse’s service would have qualified for Aid and Attendance.

- Widower: The widow was married to the veteran when the veteran passed away.

- Documentation: The survivor needs certificates of veteran’s discharge, marriage, and death.

- Health Need: The survivor needs help with two or more activities of daily living, including:

Bathing, Dressing, Eating, Toileting, Transferring, and Ambulating Within Home

Or, the survivor has a diagnosis of dementia or Alzheimer’s;

Or, the survivor has extreme blindness.

- Financial Need: The survivor has less than $123,600 in “Net Worth.” See above.

How can eligible veterans and surviving spouses apply for pensions?

- Collect Your Documents:

- Find the veteran’s discharge paperwork. This discharge paperwork will show the character of the veteran’s discharge and prove the timing of the veteran’s service.

- For surviving spouses, find your marriage certificate and veteran’s death certificate. If the veteran was married to other spouses, then the survivor also needs information about them.

- Gather statements about the veteran or survivor’s income, assets, and banking accounts.

- See A Doctor: Ask a doctor to complete form 21-2680 on the veteran or surviving spouse. He or she does not need to be the person’s primary care physician. Note that if the doctor answers question #10 as a diagnosis of dementia, Alzheimer’s, or memory loss, and answers question #27 with a “no”, this may delay your receipt of funds. The VA needs time to coordinate fiduciary responsibility with a person to receive full funds. The delay might be 3-4 months.

- Complete Your VA Pension Application:

- Call Your Connecticut Veteran Service Officer (VSO):Connecticut VSOs are state employees who provide professional, reliable, and free assistance. Pension applicants in the 1st Congressional District can call 860-278-8888 and 5th District can call 203-805-6340. Jason Coppola helps both Districts. His e-mail is jason.coppola@ct.gov. He has helped hundreds of people, and he helps all our Shady Oaks residents. Jason is also an Army Afghanistan veteran.

- Meet with Your VSO: Jason or another VSO will meet with you for an hour and help you complete your application form (21-527EZ for veterans) and (21-534EZ for widows). At Shady Oaks, families meet with Jason in our office. It is preferable for the veteran or spouse to sign the application. The VA does not recognize Powers of Attorney.

- Obtain Statement From Your Care Provider: You or your VSO should then work with your care provider (Shady Oaks) to complete a statement about your medical expenses and services.

- Submit Application: Jason or another VSO will submit your application. The VA has approved about 90% of the applications Jason has submitted. The VA operates on good faith applicant reporting and cross-checking with other government agencies. The VA said it does not always require full 3 year look-back documentation but it may specially ask for it.

- Await Results: Standard reviews take up to 8 months. For applicants over 90 years old, VSOs can ask members of Congress to help expedite reviews, so they take 3-4 months.

- Back-Pay: Upon approval, the VA back-pays beneficiaries to when they applied and begins monthly payments thereafter. It is best to apply as soon as you become eligible. For those who need time to gather documentation, ask your VSO about submitting an “Intent to File.”

Here are several helpful frequently asked questions regarding VA pensions:

- What if I cannot find the documents I need? The Newington VA medical center might have discharge papers, if the veteran received care there. State and town agencies may have copies of discharges, marriage certificates, and death certificates. For Connecticut veterans, the genealogy section of the State of Connecticut library in Hartford has discharges. Churches and funeral homes may also have copies of discharges, marriage certificates, and death certificates.

- What if the veteran or spouse moves assets into a son or daughter’s name? The VA now counts gifts and below market transfers made after 17 October 2018 in calculations of net worth.

- What if the VA rejects my application? The VA permits veterans and survivors to revise and resubmit incomplete applications. A VSO can help ensure your application is complete.

- What if selling a house increases net worth back over $123,600? Beneficiaries may exceed net worth eligibility within a calendar year, but they must report remaining excess by year’s end. The VA will then suspend benefits until if the beneficiary’s net worth returns below $123,600. The VA permits selling one home to buy another home within the year. Mortgages on primary homes do not deduct from net worth. Apartment rent in a non-care community is not deductible.

- What if the veteran or survivor begins receiving Medicaid? These pensions only pay up to $90 a month to veterans and survivors who receive Medicaid benefits. For this reason, these pensions are best for people in assisted living communities and for those who hire home care.

- What if the veteran or surviving spouse passes away before the pension begins? If the veteran or surviving spouse has a spouse or children, the VA may send accrued benefits to them. The VA only pays accrued benefits up to the amount of the veteran or spouse’s funeral bill. For example, if there are $10,000 in accrued benefits, and the burial bill is $8,000, then the children will only receive $8,000 shared between them. In such a case, the spouse or child who signs the deceased veteran or spouse’s funeral bill must also be the one who signs the VA application for accrued benefits. The VA requires that the spouse or child file this application for accrued benefits within one year of the veteran or surviving spouse’s death. Note that these accrued benefits can only go to spouses or children, not to persons of any other relation. If the veteran or spouse died without a living spouse or children, the VA does not pay accrued benefits.

What to Learn More about VA Pensions in CT? Call Dawn at 860-594-6604.

For more information or to contact Shady Oaks click here!